We're transparent with our pricing

We always strive to be as open and clear as possible. Here you can see exactly how we derive our prices and what we do with your money.

Where we source our pricing

FOREX.com sources prices for our CFD trading and spot FX markets from a range of sources, including:

- - Applicable primary exchanges

- - Alternative liquidity providers

We also utilise pricing sourced from our parent company, StoneX (Nasdaq: SNEX), a multi-national payments and global securities specialist. These proprietary prices are not available through any other brokerage, meaning we can provide our traders with competitive pricing and exceptional liquidity.

For OTC (over-the-counter) assets such as FX markets, we source pricing from a number of Tier 1 financial institutions and Electronic Communications Networks (ECNs). This enables us to tap into deep liquidity from around the world, including financial centres such as New York and London. We have access to over 10 different sources of liquidity to help secure our clients the best pricing and liquidity possible.

FOREX.com acts as a market-maker for all of the markets we offer. We use various methodologies to price each market depending on each individual market and asset class.

The pricing for each market is derived from a number of top-tier liquidity sources, all delivered to you at the best possible price with minimal latency.

Our state-of-the-art systems stream continuously tradable prices within the published trading hours for the specific product. However, some products are inherently illiquid and even liquid products sometimes undergo periods of illiquidity.

For a given underlying asset, we offer a variety of products that have different characteristics, each suited to a different profile of client:

Fixed spreads

Variable spreads

Capped variable spreads

In addition to this, there are occasions when illiquidity is so severe that prices in the market are completely withdrawn. Also, if the spreads are extremely wide, we will temporarily disallow trading products by continuing to show the client the current price but clearly displaying it as a indicative price.

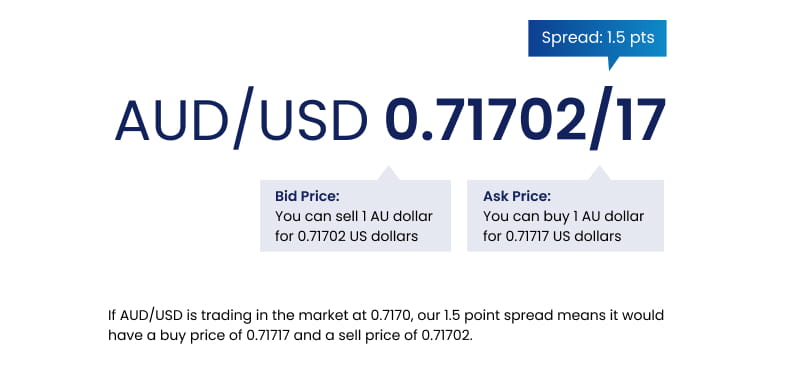

FOREX.com makes money through the spread, meaning we do not directly profit from when you win or lose.

In most cases, clients’ positions will balance each other out. Some traders will opt to buy a certain market while others will choose to sell the same market – this is known as internalisation.

We may have periods when the majority of our traders are opening positions in the same direction. If this occurs, we hedge these positions in order to manage company funds and mitigate risk. As an example, if clients are mainly shorting Wall Street, we would then hedge these positions by opening positions in the Dow Jones futures market.