Financial strength and security

A track record of financial strength

FOREX.com's parent company is StoneX Group Inc. (NASDAQ: SNEX), a Fortune 100 financial services provider with 100 years in the industry.

As a global, publicly-traded company, StoneX must meet the highest standards of corporate governance, financial reporting and disclosure.

-

1

Canada

Canadian Investment Regulatory Organization (CIRO)

-

2

Cyprus

Cyprus Securities & Exchange Commission (CySEC)

-

3

USA

The National Futures Association (NFA)

Commodities Futures Trading Commission (CFTC) -

4

Cayman Islands

Cayman Islands Monetary Authority (CIMA)

-

5

UK

Financial Conduct Authority (FCA)

-

6

Hong Kong

The Securities and Futures Commission (SFC)

-

7

Japan

The Financial Services Agency (FSA)

-

8

Singapore

The Monetary Authority of Singapore (MAS)

-

9

Australia

The Australian Securities and Investments Commission (ASIC)

Fund security

We’re fully authorised and regulated in Australia by the Australian Securities & Investments Commission (ASIC). As co-founders of the Australian CFD and FX forum, we are committed to ensuring full segregation of client funds and hold client funds in accordance with the Client Money Rules.

We only use our funds to manage hedge positions and do not engage in proprietary trading.

Customer margin

If faced with a margin call, you should be alerted by us, but we strongly recommend you monitor your margin indicator carefully. Open positions may automatically be closed as quickly as possible in the largest loser order to protect you from further losses.

Our retail clients also benefit from negative balance protection, meaning losses cannot exceed deposits.

It is your responsibility to be aware of your net equity balance, as well as your margin requirements and margin indicator for open positions at all times. For more information, please refer to the CFD Customer Agreement and Product Disclosure Statement.

Our commitment

FOREX.com supports regulatory oversight and transparency, and we undergo regular audits. We are fully committed to communicating any changes with our clients clearly.

We constantly review practices across our business, including:

- Business continuity and disaster recovery

- Risk management

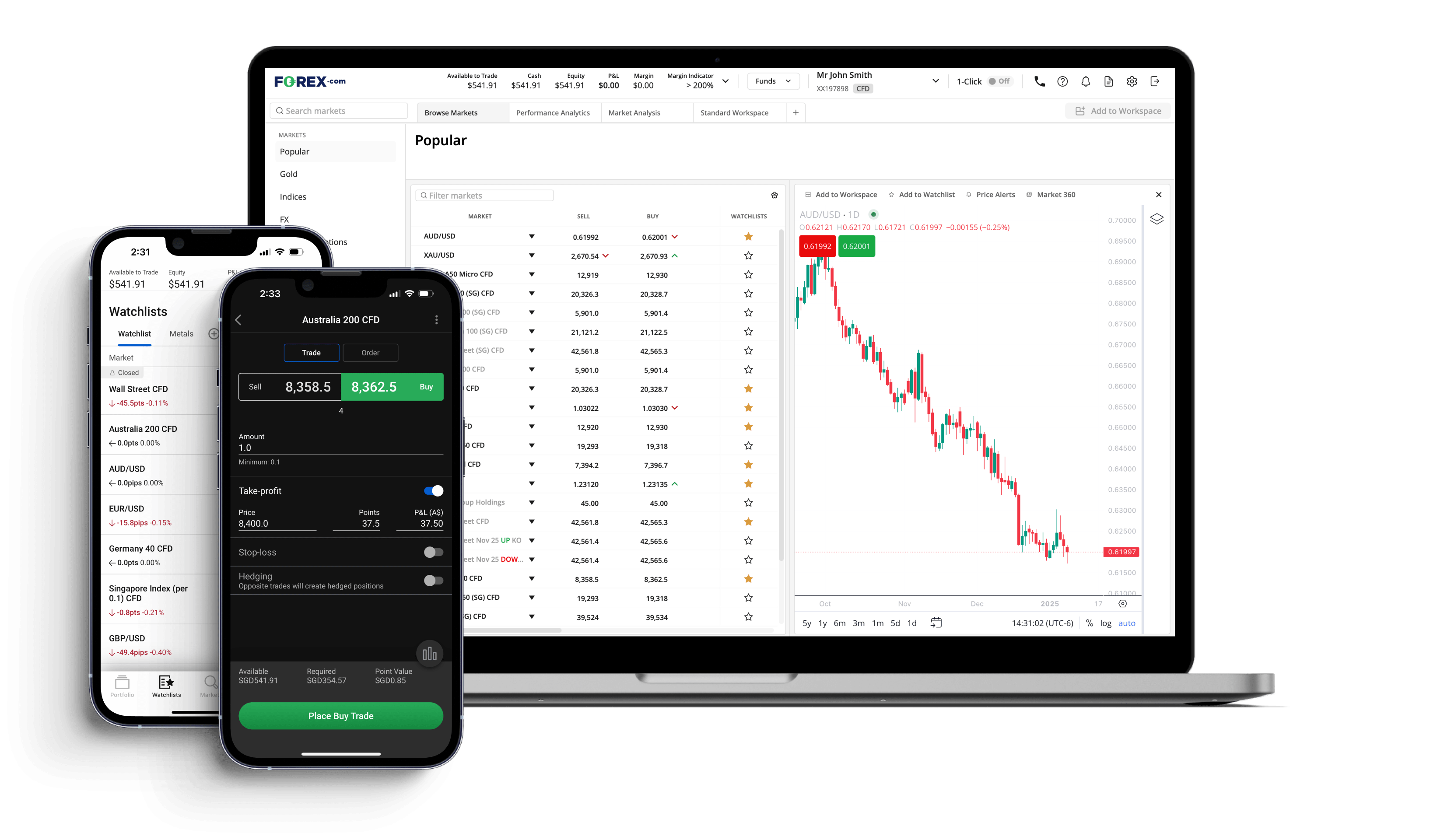

- Supervision of electronic trading systems (i.e. platforms)

- Information security

- Anti-money laundering

- Customer complaints

- Trade reporting